The era of digitalization has completely transformed the way people kept themselves entertained. In a recent Global Consumer Streaming Habits survey, it has been declared that among all respondents, 58 percent stream content in any event once every week by means of a keen TV or streaming devices, 51 percent on a cell phone, and 50 percent on a PC or laptop. Recent college grads (19-multi year olds) lead the route in all classes announcing 72 percent, 73 percent, and 65 percent, individually. We need to understand that how this varying behavior is impacting the companies

In developed countries like Europe, there is a high Internet infiltration pace of 77% which has set off a blast in this segment. While Pay TV still holds a critical portion of video utilization with more than 170 million endorsers crosswise over Europe as against 35 million online video watchers , content utilization from computerized stages is developing at a gigantic pace. European Commission’s Digital Single Market (DSM) technique, which endeavors to make a good domain for computerized exchange by methods for framework activities (Ex: Launch of 5G) and administrative changes , is set to help the development of OTT video advertise. The market size in income for associated video on demand services in Europe developed at a yearly development pace of 40% to reach €4.3 billion out of 2016. Such footing has been especially determined by higher appropriation of worldwide SVOD monster, Netflix, whose supporter numbers have dramatically multiplied since 2012 when it initially propelled its administrations in UK and Ireland. Advanced mobile phones and Smart TVs, specifically, have caused an enormous move in viewership patterns. Ice and Sullivan gauges that 65% of all Internet clients are dynamic video watchers through platforms, for example, Tablets, PC, Laptops, Smartphones, and Smart TVs. SVOD stages today endeavor to give an intelligent client experience independent of the gadget they use.

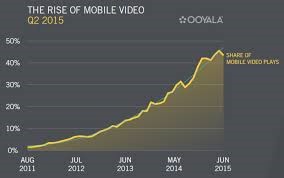

In developing countries like India, over-the Top (OTT) video viewing is a digital wave transforming the way we consume videos in India. Television is viewed almost everywhere, on-demand, on-the-go, across devices and geographies, owing to burgeoning OTT platforms coupled with rapidly increasing Internet services. With increasing bandwidth capacity and falling prices, telecom operators are engaged in price wars to offer the best bundles for voluminous media consumption. The growth in smartphone penetration and improvement in Internet speeds are disrupting television screening, evolving into a multi-screen, time-shifted, mobile environment with viewers deeming their smart device as their primary source of media and entertainment. The OTT video market in India is bustling with competition, as leading operators Hotstar, dittoTV, Jio TV, Amazon Prime Video, Netflix, ErosNow, and YuppTV battle to penetrate this lucrative market. According to Frost & Sullivan, there were 70 million unique video viewers in India in 2016, with 1.3 million paid subscribers. Currently there are at least 80 Million unique connected video viewers, with at least 1.75 Million OTT paid video subscribers. With a high growth rate of almost 30%, this number is rising rapidly with the recent unveiling of Jio’s services. The OTT market is riding on the mobile revolution in the country, as 75% of videos are consumed on mobile devices.

Middle East and North Africa: The Internet infiltration is changing customary (TV) viewership designs in the Middle East and North Africa (MENA) district, making a tremendous, rich market for over-the-top (OTT) video administrations. Not withstanding government support for Internet omnipresence and enormous scale advanced change, the nearness of a huge, youthful populace that is all around familiar with portable innovation is drawing in critical ventures to this market. While by and large Internet entrance levels have soared, the absence of consistency in broadband accessibility ruins the arrangement of OTT administrations to different nations that have a huge introduced base of inheritance innovation. In addition, watchers are familiar with feee to-air (FTA) channels and online recordings because of the absence of an administrative structure. The ensuing drowsy take-up of paid memberships has eased back the arrival on venture on OTT administrations, offering respite to a few telecasters

In such a strongly focused market, content makers and merchants are continually reevaluating themselves to give a joined stage that can empower purchasers to get the substance of their decisions as well as an ideal client experience, where personalization of substance, proposal, and investigation are significant. In-house content generation, multiplatform similarity of video content, increment in predominance of OTT spilling gadgets, for example, Roku, Chromecast, Apple TV, etc are indicating a market that is advancing toward union. In such a strongly focused market, content makers and merchants are continually reevaluating themselves to give a joined stage that can empower purchasers to get the substance of their decisions as well as an ideal client experience, where personalization of substance, proposal, and investigation are significant. In-house content generation, multiplatform similarity of video content, increment in predominance of OTT spilling gadgets, for example, Roku, Chromecast, Apple TV, etc are indicating a market that is advancing toward union.